By J.B. Heaton (J.B. Heaton, P.C.) Solvency plays important substantial roles in both bankruptcy and corporate law. In practice, …

Continue Reading about Simple Insolvency Detection for Publicly Traded Firms

By J.B. Heaton (J.B. Heaton, P.C.) Solvency plays important substantial roles in both bankruptcy and corporate law. In practice, …

Continue Reading about Simple Insolvency Detection for Publicly Traded Firms

By Kenneth Ayotte (University of California, Berkeley School of Law) Complex capital structures are prevalent in many recent …

Continue Reading about Disagreement and Capital Structure Complexity

By O. Cem Ozturk (Georgia Institute of Technology - Scheller College of Business), Pradeep K. Chintagunta (University of Chicago), …

The Federal Reserve Bank of New York’s Liberty Street Economics Blog has run a series of five posts seeking to estimate the total …

Continue Reading about How Much Value Was Destroyed by the Lehman Bankruptcy?

By Peter S. Saba (Jones Day). In In re Houston Regional Sports Network, L.P., 886 F.3d 523 (5th Cir. 2018), the U.S. Court of …

By Charles Tabb and Tamar Dolcourt (Foley & Lardner LLP). In July, the Seventh Circuit Court of Appeals issued a decision …

Continue Reading about Junior Creditors Could Share In 363 Bankruptcy Sales

Kenneth Ayotte (U.C. Berkeley School of Law); Edward R. Morrison (Columbia Law School) In bankruptcy, valuation drives disputes. …

Continue Reading about Valuation Disputes in Corporate Bankruptcy

by Charles M. Oellermann and Mark G. Douglas (Jones Day). In their annual chronicle of business bankruptcy, financial, economic, …

By Song Ma (Yale School of Management), (Joy) Tianjiao Tong (Duke University, Fuqua School of Business), and Wei Wang (Queen’s …

By Samuel Antill and Steven R. Grenadier (Stanford Graduate School of Business) In this work, we develop and solve a …

On October 28, 2017, the United States Court of Appeals for the Second Circuit handed down its decision in In re MPM Silicones, …

By Kose John (New York University & Temple University), Mahsa S. Kaviani (Temple University), Lawrence Kryzanowski (Concordia …

Continue Reading about Creditor Rights and Corporate Debt Structure Around the World

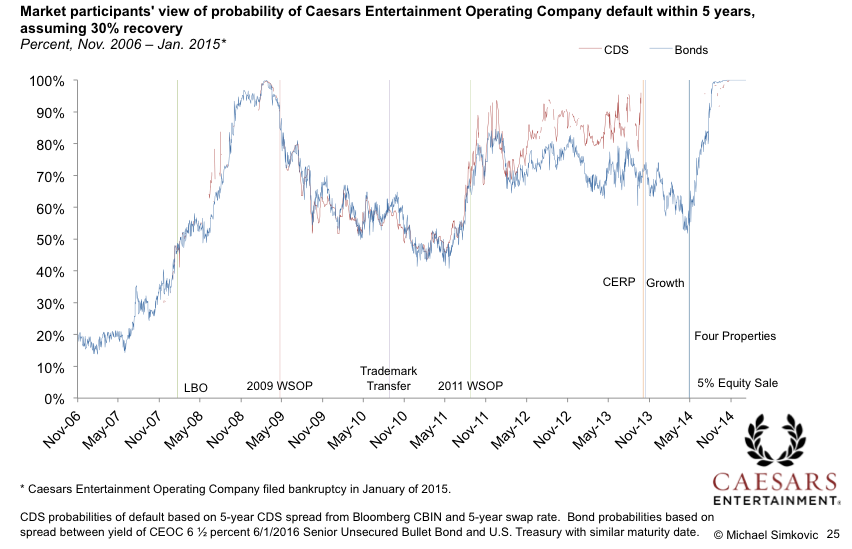

By Michael Simkovic, Seton Hall University School of Law Valuation, solvency, and adequate capitalization analyses play a crucial …

Continue Reading about The Future of Solvency and Adequate Capitalization Analysis

Timothy C.G. Fisher, University of Sydney Ilanit Gavious, Ben-Gurion University of the Negev Jocelyn Martel, ESSEC Business …

Continue Reading about Earnings Management and Firm Value in Chapter 11

By Andrea Pawliczek, Leeds School of Business, University of Colorado - Boulder The structure of executive compensation …

Continue Reading about The Effect of Executive Compensation on Recoveries

By Michael Vitti, Duff & Phelps Much has been written about Momentive. Nevertheless, some relevant questions are not often …

By Maxwell Tucker of Squire Patton Boggs The correct method to determine the adequacy of the “cram-down” interest rate offered …

Continue Reading about Cram-down interest rates in controversy

By Michael D. Pakter, Gould & Pakter Associates, LLC Given the increasing number of professionals who are performing business …

Continue Reading about New AIRA Standards on Distressed Business Valuation

By Lawrence Safran, Mitchell A. Seider, Keith A. Simon, and Adam J. Goldberg of Latham & Watkins LLP Intercreditor agreements …

Continue Reading about The Weakest Link in Intercreditor Agreements Breaks Again in Momentive

By Adam C. Harris and Karen S. Park of Schulte Roth & Zabel LLP A recent decision from the Bankruptcy Court for the Southern …